The Brief

The Co-operative Bank stands out in New Zealand's banking landscape as the only institution sharing profits with customers through rebates. This contrasts sharply with the country's banking sector, dominated by four Australian-owned banks known for their high profitability and focus on shareholder returns. In 2023, Co-op Bank paid $2.5 million in customer rebates, reinforcing its unique position.

The bank also recently refreshed its brand with the #BankBetter campaign.

Our challenge was to develop an innovative communication strategy for The Co-operative Bank that highlights its profit-sharing model, differentiates it from competitors, leverages the #BankBetter campaign, playfully challenges the dominant banking oligopoly, and effectively communicates the rebate payout to customers.

Simply put, create a compelling approach that showcases Co-op Bank's customer-centric model while standing out in a competitive market dominated by the big Aussie banks.

The D3 Approach

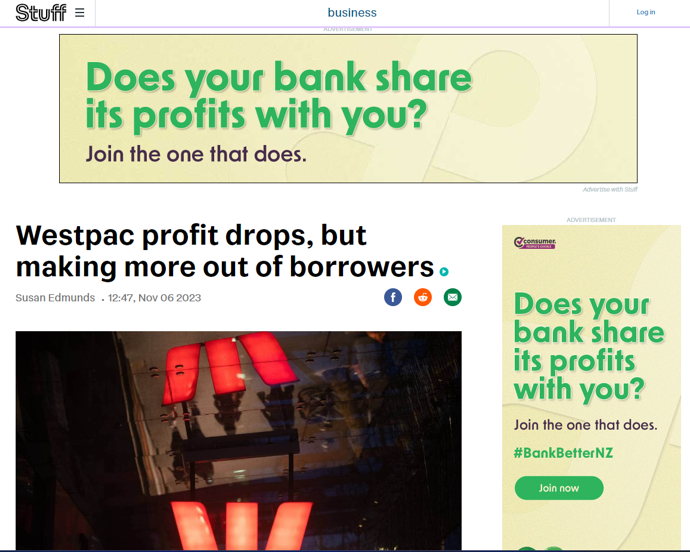

We identified a key opportunity in the way the big four banks communicated their profit results. While these banks didn't directly inform their customers about their profits, financial news outlets regularly covered these announcements in detail, creating a perfect backdrop for our campaign.

Our strategy centred on creating a powerful presence for The Co-operative Bank's "Bank Better" message precisely where discussions about competitors' profits were taking place. We aimed to intercept readers when they were engaging with news about bank profits, offering them an alternative perspective.

To implement this, we formed strategic partnerships with New Zealand's leading news outlets, specifically NZ Herald and Stuff. These platforms were chosen for their significant reach and reputation as go-to sources for financial news. We implemented advanced targeting techniques to identify and "roadblock" all articles related to the big four banks' profit results, ensuring our ads would appear prominently alongside or within these specific articles.

Our ad creative was carefully crafted to highlight The Co-operative Bank's unique profit-sharing model. We used attention-grabbing headlines like "There's a better way to bank" or "What if these profits went to customers instead?" The ads featured the #BankBetter hashtag to tie into the broader campaign.

We set up our system to activate automatically whenever articles about bank profits were published, ensuring our message was timely and relevant. Our ads appeared simultaneously with the news. Clicking on our ads led readers to a landing page that contrasted The Co-operative Bank's rebate system.

This approach allowed us to address readers already engaged with banking and profitability topics directly. We measured success through metrics such as click-through rates, time spent on our landing page, and subsequent enquiries about Co-op Bank accounts.

By contextually targeting these profit articles, we created a powerful juxtaposition between the big four banks' focus on shareholder returns and the Co-op's customer-centric model. This strategy raised awareness about The Co-operative Bank and positioned it as a thoughtful, customer-focused alternative in a market dominated by profit-driven institutions.

The Results

The campaign ran for approximately two weeks, delivering over 1 million impressions across NZ Herald and Stuff. It achieved an average click-through rate (CTR) of over 0.5%, a strong financial service performance. This level of engagement indicates that our contextual targeting strategy successfully captured the attention of readers actively consuming news about bank profits.

The campaign's impact extended beyond mere numbers. It was exceptionally well-received within The Co-operative Bank, with team members across various departments expressing enthusiasm for its innovative approach and alignment with its values.

Perhaps most notably, the campaign garnered plaudits from marketing teams at competitor banks and agencies. This recognition from industry peers underscored the campaign's creativity and effectiveness in differentiating The Co-operative Bank in a crowded market.

The positive reception from both internal stakeholders and competitors validated our strategic approach. It demonstrated that by directly addressing the issue of bank profits in a clever, contextually relevant manner, we raised awareness for The Co-operative Bank and sparked meaningful conversations about banking models and customer benefits in New Zealand's financial landscape.